Join Dave Swan, Senior Vice President of Products at Trackunit, as he delves into the landscape of competitive sustainability. Drawing from the illuminating insights of Trackunit’s ‘Constructing a Better Future’ report, Swan offers a compelling perspective on navigating the evolving terrain of sustainable practices in the industry.

We’ve been banging the drum on competitive sustainability since Autumn 2023 and, as our recent sustainability report showed, the evidence is mounting that it’s here, it’s real, and it’s accelerating.

This subject and the change we are witnessing really matter because it reflects a cultural shift in attitudes towards sustainability within the industry that is game-changing.

We can underpin that premise with real, hard data from the ‘Constructing a better future’ report. Published at the end of February, the report based on questionnaires from nearly 13,000 construction professionals unveiled dramatic and at times surprising findings that suggest the direction of travel is increasingly one way and even more significantly, the pace of that travel is accelerating.

Trajectory

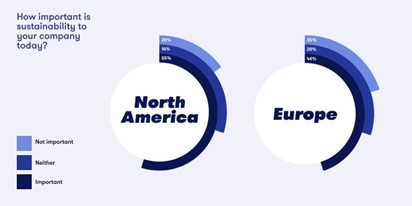

Let’s take North America first and the sharp shift in trajectory that has really caught the imagination of the industry. We’ve never been surprised when Europe leads the way on sustainability however, the dramatic rise of competitive sustainability in North America manifested in the report’s finding that 36% of construction professionals consider sustainability to be ‘very important’ as against Europe’s 25%, was an eye opener.

Add in those who consider it to be ‘important’ and the respective scores of 55% and 46% demonstrate two things: firstly, that the differential is consistent and obvious and secondly, sustainability really has shot to the top of the agenda in North America.

Take a moment to digest this as this really is an astounding insight. Although we had an inkling, we didn’t expect this to be one of the outcomes of the report and it’s important to say that this is not construction professionals in Europe suddenly slackening the focus on sustainability or shifting their attention elsewhere. Anyone familiar with Northern Europe and The Nordics, in particular, will know that the narrative is absolutely dominated by being better at sustainability.

It simply means that North America is being driven by a competitive sustainability dynamic led by key players in the industry such as Virginia-headquartered engineering and construction company Bechtel. Bechtel, like Texas-headquartered Fluor Corporation, Clark Construction Group and Turner Construction among others, is effectively using KPIs as a tool to drive incredible behavioural changes from the senior level right down to machine operators.

In practice, that’s profound. If a company now has an ESG target, the CEO will expect quarterly reports from the regional leads on all aspects including re-fleeting decisions and where the improvements have to be made. That means hard KPIs are cascading downwards to the site level and site project owners telling them you need to actively change management to reduce their CO2 emissions against the average. As Bechtel’s website states: ‘Each of our projects that require reporting is developing and implementing a formal, project-specific climate action plan for reducing and managing emissions’.

Benchmarking

Once you start treating these KPIs exactly like revenue targets with specific reductions in CO2 per machine over the previous 12 months and over the next 12 months, then the impact of that on behavioural change and the benchmarking implications become obvious.

I first began to see the tentative signs of this as long as two years ago, but there is little doubt that this has gathered enormous pace in the last six-12 months as companies get better at harnessing the technology on emissions reporting and developing their ESG strategies accordingly. That should have a profound effect over time on CO2 emissions.

This is of course not a zero-sum game. If North American construction companies can exert an influence both on the local industry and throughout the globe, that’s a win for everyone. If this helps construction companies in those parts of Europe where it is not so high on the agenda to up their game on sustainability practices, then it becomes a virtuous circle of better behaviours.

Asia would hardly be immune to this either. China already leads the way in solar panels production and the continent is littered with excellent examples of companies doing great things. Once practice is implemented by industry leaders and societal and regulatory factors are added to the mix, the increasing likelihood of a domino effect is evident.

Does that sound like hyperbole? Well then let me direct you to the evolution of the electric vehicle industry which has come from a standing start a decade ago to an expected 16.7 million EV sales in 2024. And, while Tesla has been the headline grabber of the last few years, it faces sharp competition in the EV space as rival manufacturers emerge across the globe.

Connectivity

EVs illustrate that competition by its nature finds new solutions and suggest that the remarkable KPIs we are seeing in US construction might in two to three years’ time be considered normal and perhaps even behind the curve. That is after all how benchmarks emerge and strengthen little by little. And there are many good reasons to anticipate this happening in construction.

All of this is premised on connectivity and that is an area in which construction still has a way to go. By definition, the more connected the industry becomes, the easier it will be to track emissions, engine idling data and other CO2-related activities and take action to address them.

It is exactly where the leading IoT solutions providers can provide the grease to smooth construction companies’ processes to meet hard KPIs. We know there are long-term solutions on the horizon like lithium-powered excavators or where contractors rely less on combustion power but for the foreseeable future, they are going to have to be dependent on existing fleets.

Insights

So that means being equipped with the sustainability data that can deliver the insights they need to implement change management today and meet their KPIs. Once you add in the pressure being exerted by UN targets on emissions, state-mandated stringent environmental criteria, society’s desire for better solutions and the innate will for change within the industry, then it is a powerful cocktail for improvement. And with technology increasingly fulfilling its end of the bargain, that’s a powerful proposition.

I believe the direction of travel is only going one way. If that’s right, then competitive sustainability is here to stay and, because it is underpinned by behavioural shifts, will dramatically impact construction’s CO2 debt moving forward. With construction reportedly responsible for 37% of all global CO2 emissions, as stated by the UN environment programme, that is a major development.

For more insights on the state of construction and sustainability and the dynamics that are propelling the industry towards better practices and stronger emissions reporting records, download your copy of ‘Constructing a better future’ here.